- Intellery

- Posts

- 🧠AI Meets Open Banking: Every Fintech’s Dream

🧠AI Meets Open Banking: Every Fintech’s Dream

A new era of fintech innovation in Nigeria

Perspective

Hi Ayodele here,

Welcome to the first edition of the Intellery Perspective series.

Each month, Perspective offers a closer look at the ideas, trends and milestones shaping Africa’s AI ecosystem. It is where we go beyond surface updates to examine the ideas, trends, and policy moves that are redefining what is possible. If you are looking for thoughtful analysis grounded in local context, you are in the right place.

In this edition, we explore how Nigeria’s move toward Open Banking could unlock a new era of AI-powered innovation in the financial services space especially for fintechs. From smarter credit scoring to intelligent agents and personalized finance, access to better data might just be the missing piece every fintech has been waiting for.

Let’s get into it.

AI Meets Open Banking: Every Fintech’s Dream

There is a lot our spending habits can reveal about us. A popular story is that of Target, the retail chain. If you have come across it before, you probably already know just how powerful AI can be. If not, here is a quick recap.

Target was able to predict women’s estimated pregnancy due dates based on the products they purchased. The company used this information to send personalized catalogs and offers. One day, a frustrated customer reached out to complain about the pregnancy-related offers being wrongly sent to his teenage daughter, only to discover weeks later that his teenage daughter was actually pregnant.

Over the years, this particular story has generated mixed reactions about data. However, the main point remains: data is incredibly powerful and when combined with advanced techniques, it can reveal far more about who we are. Oftentimes, transactional data reveals far more about us than what we choose to manually provide through forms or surveys.

We all know that data is the fuel of AI. Without data, AI simply cannot function. There is also a second truth: poor data results in poor AI. It is the classic “garbage in, garbage out” principle. No wonder so many companies are now competing to acquire the best quality data.

Whenever quality data becomes accessible it opens up an era of innovation. That is why I was excited when I heard about the Central Bank of Nigeria's approval to launch Open Banking in August 2025. This decision opens the door to a new era of innovation for fintechs and also challenges traditional banks to raise their game. Open Banking doesn’t only make data available, it makes “quality” data accessible.

If you are wondering why this excites me so much, let me explain with two examples from the past.

The Story of Two Fintechs

Back in 2018, I was fascinated by two fintech startups: Paylater (now Carbon) and Reach. Around that time, I had pivoted from management consulting to data science the year before (2017) and I had become passionate about analytics, machine learning, and deep learning. Thanks to platforms such as Data Science Nigeria, Technidus, and AI Saturdays, we had a growing community of people building, learning, and collaborating in this space. In some of these communities, we were constantly looking out for companies leveraging data science and AI, and whenever we found one, it quickly became a topic of discussion. Back to the startups let’s talk about each one.

source: Carbon, Reach

Carbon

Carbon stood out to me because it was giving out loans using machine learning algorithms. This was an unconventional approach back then. They did not ask for collateral or guarantors, unlike traditional lenders. I found their use of machine learning innovative and inspiring. I had done online courses on similar topics and even built personal projects, so seeing a Nigerian fintech applying these ideas in the real world was exciting. I even wrote about Paylater in this 2018 article.

source: Carbon

One day, I needed money urgently. I had gotten some help from a friend but needed more so Carbon was my first choice. After asking for details I assumed were model parameters (like salary, rent, house location, etc.), they made an offer. The offer was lower than I expected but then they asked for more data (specifically my bank statement) if I wanted a higher offer. After providing a 12-month statement from one of my accounts, I got a slightly higher offer, but it was still below my expectation. In the end, I went with another lender focused on salary earners, because the process was faster and met my immediate need.

A key issue in the above scenario was data. Carbon had only one of my bank statements even though I had other accounts across various banks. I had provided just one statement and I wasn’t ready to go through the stress of providing multiple statements. What if I did and the offer was still not great? I wasn’t going to risk it. Also even if I had, extracting data from multiple statements is a difficult task for engineering teams. Each bank uses a different format, and every time a format changes, engineers need to adjust their extraction pipeline. If they do not, the output might be wrong or even empty. Extracting data from various statements can be a nightmare trust me.

So while Carbon’s approach was innovative, it was limited by access to quality data (complete and consistent data).

Open Banking solves this problem in a clean, structured way. I will come back to that shortly.

Reach

Reach was well known as a personal finance app. A friend recommended it to me when I was struggling to manage my spending. I could not figure out where my money was going each month.

source: Reach

Reach was fun to use and, as a machine learning practitioner, I found it quite clever. It used natural language processing techniques to analyze SMS messages from your phone and categorize transactions. That alone was impressive but it had its flaws. I had tried to build similar models myself, and I knew firsthand how messy bank SMS messages could be. The formats differ from bank to bank, some messages look incomplete, and others are just cryptic (especially those POS notifications). It was no surprise that Reach would sometimes misclassify or duplicate transactions. It was a great idea but limited again by access to quality data.

Now imagine if Reach could pull transactions directly from users’ bank accounts instead of SMS messages. It would still not be perfect, but definitely more accurate and scalable.

That is the promise of Open Banking.

What Open Banking Unlocks

Open Banking not only gives fintechs access to more data but also better data. It standardizes formats and allows for a more complete view of customer behavior. This opens up a wide range of possibilities for AI applications.

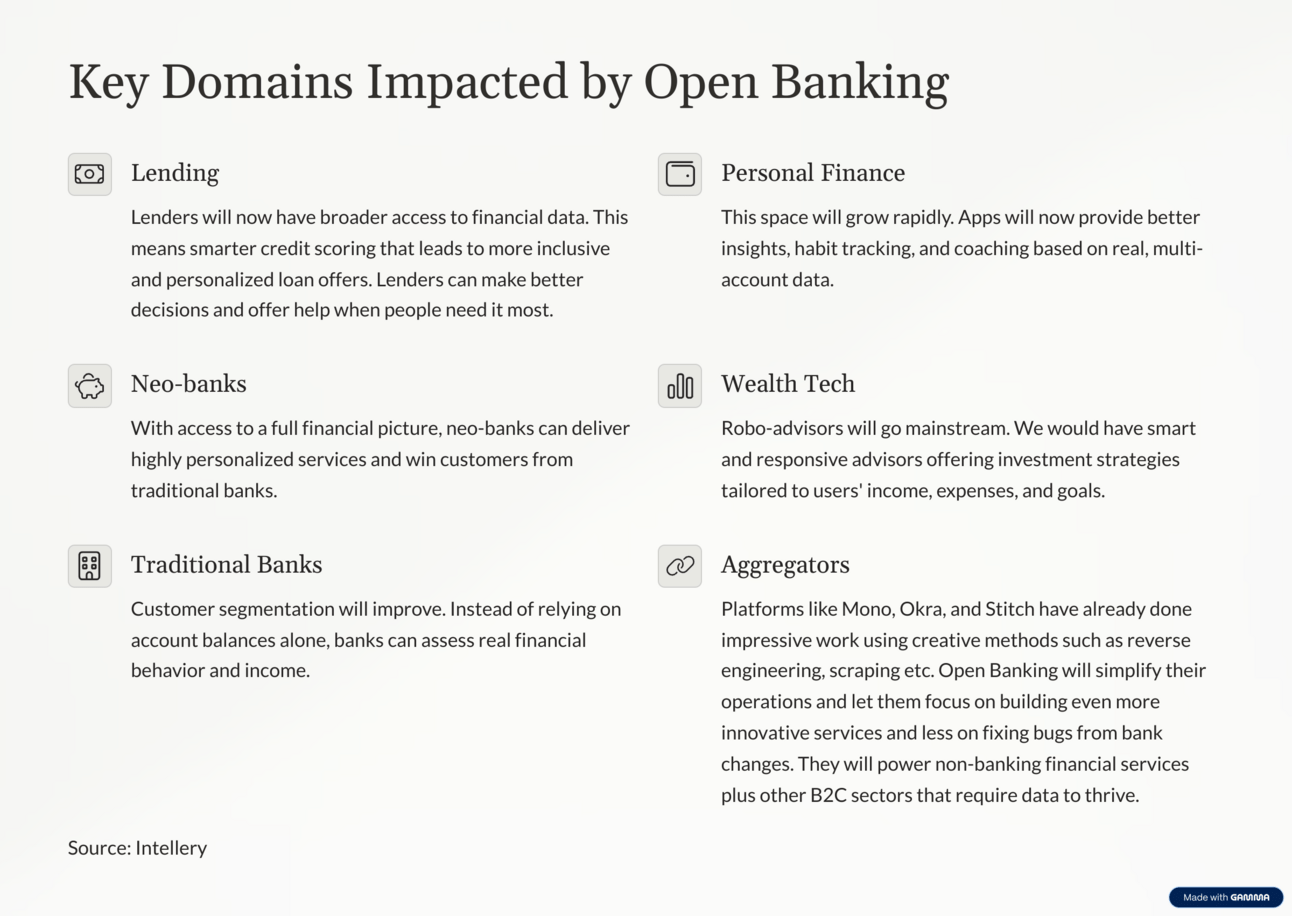

Before diving into specific use cases, let us highlight the fintech domains that will benefit the most:

8 AI Use Cases that will thrive in the Open Banking era

1. Proactive Chatbots

Chatbots have come a long way since 2018 when we had the first wave of chatbots. Early versions were rule-based and very limited. With large language models, we moved to smarter systems that understand context and nuance, thanks to techniques like Retrieval-Augmented Generation (RAG) and function calling. Today, chatbots handle enquiries and requests more effectively. In the Open Banking era, we are entering a new phase where chatbots go beyond basic interactions to offer tailored product suggestions and personalized financial advice.

Picture this, Kike is chatting with a bot from a Neobank and wants to buy that new bag she has been eyeing on the Neobank’s market place.

The bot responds:

"Kike, your balance is low, you can’t afford this right now. You have your 13th month allowance coming in next month so that’s a perfect time to get this. If it cannot wait, I can offer you a quick loan to help cover it. You are close to finishing repayment on your two existing loans, so this should be fine."

2. AI Agents

Visa recently launched AI commerce agents for cards and it was impressive. No doubt this is the future. With Open Banking, AI agents can become even more useful. They can understand your spending patterns, execute transactions across your accounts through voice commands, scan payment details from payment display stands, and make payments on your behalf across accounts. You could tell it to search for best deals and pay on your behalf across accounts.

Before you assume this is something far off, it is worth noting that AI agents can already search the web, extract text from images, and respond to voice commands. While voice understanding still needs improvement, that is exactly where companies like Intron and other African AI startups focused on speech are playing a critical role. This future is not far away. It is closer than many people think.

3. Smarter Credit Scoring

AI models will now be trained on more complete financial histories, pulling data from multiple accounts and platforms rather than relying on a single source. This broader view allows for a more accurate understanding of a person’s financial behavior, spending habits, and income patterns. As a result, credit decisions can become more inclusive.

4. Behavioral Segmentation

Most organizations currently segment customers using limited information from KYC data and the few transactions they can see. These segments are often suboptimal, but they represent the best possible outcome given the available data. With Open Banking enabling access to transactional data across multiple accounts, organizations can now use AI to segment customers based on real financial behaviors such as spending habits, income streams, and debt levels. This shift allows for more accurate, meaningful, and actionable segmentation that goes beyond surface-level insights.

5. Propensity Modelling

Product recommendation will move beyond the traditional spray-and-pray approach. With access to aggregated data from multiple financial institutions, AI models can now make more accurate predictions about product adoption whether it is loans, insurance, or investments. These models can factor in a wider range of behavioral signals and life events, allowing fintechs to offer the right product to the right person at the right time.

6. Next Best Offer Modelling

With Open Banking data, it becomes easier to use AI to predict a customer’s next purchase. Take bill payments, for example. I might use Bank A as my primary account but pay my bills through Bank B. With Open Banking, Bank A can now see those transactions and understand my payment patterns. This visibility allows them to accurately anticipate when I am likely to make my next bill payment and present timely, personalized offers or reminders that are actually relevant.

7. Robo Advisory

Access to full financial profiles enables more tailored investment advice, as AI can analyze actual income, spending habits, liabilities, and savings goals across all accounts. This holistic view allows for smarter, data-driven recommendations. Questions like:

How much should I invest each month?

Is it safe to allocate a portion to crypto as a trial?

Which stocks align with my risk profile?

How should I balance my investment portfolio?

These can all be answered more effectively with AI, giving users personalized strategies grounded in their real financial behavior.

8. Smarter Churn Prediction

Monitoring transaction patterns and balance movements across multiple institutions can reveal early signs of customer disengagement. With this insight, businesses can act proactively offering timely incentives, support, or personalized services to retain customers before they fully disconnect.

Final Thoughts

Open Banking is a game changer for the financial services space in Nigeria. It offers cleaner, richer, and more reliable data that can power better AI. With smarter models, fintechs can offer more value to users, from personalized advice to better credit decisions.

For AI practitioners, data analysts, and fintech operators, this is a new era. One where we can finally build intelligent systems that understand customers fully and serve them better.

Reply